The financial influence of COVID-19 is simple. Companies all throughout the globe are studying adapt to those new circumstances. We’re all studying function in a “new regular” that’s continually altering.

That’s why from now till the tip of June, we might be publishing week-over-week pattern knowledge for core enterprise metrics together with resembling web site visitors, electronic mail ship and open charges, gross sales engagements, shut charges and extra. We plan so as to add extra cuts, like channel and area, over time.

This week, we’ve added an extra dimension to our dataset -- firm dimension. You possibly can discover all the info we’re publishing here.

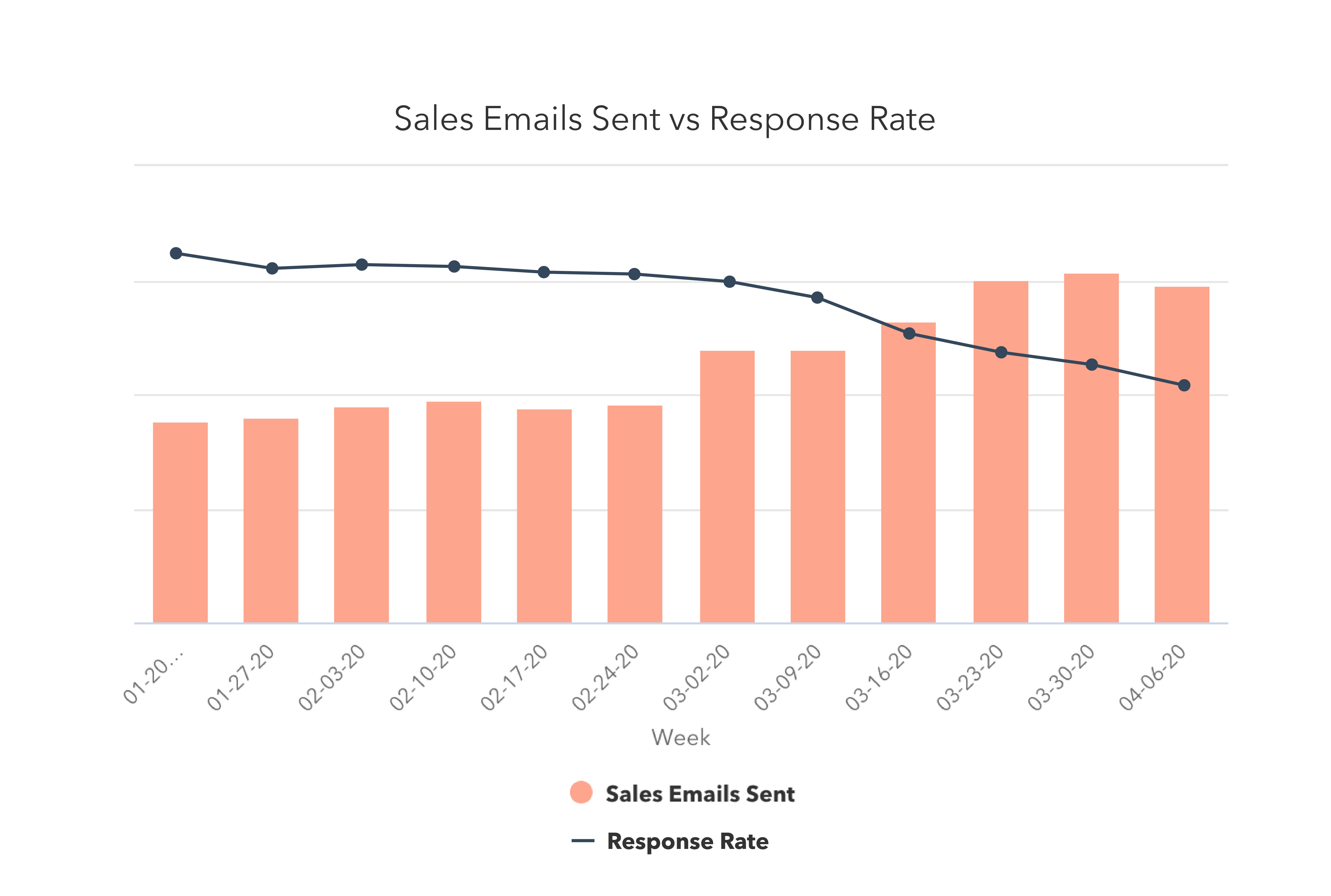

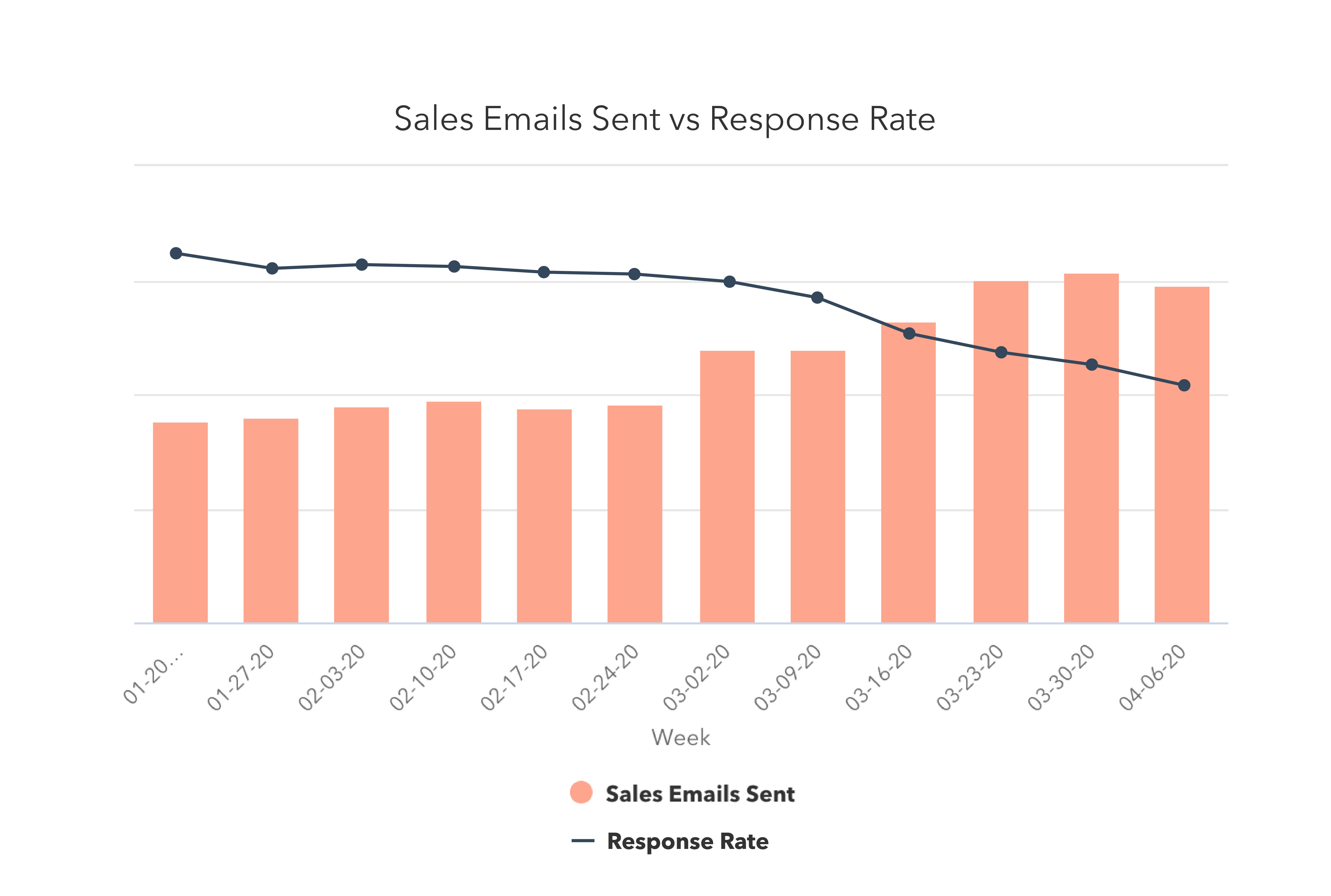

Gross sales groups are sending about 50% extra electronic mail to prospects than they have been pre-COVID, however responses proceed to drop. Final week, gross sales response charges hit an all-time low for 2020 at 2.1%, a decrease response price than Christmas week 2019.

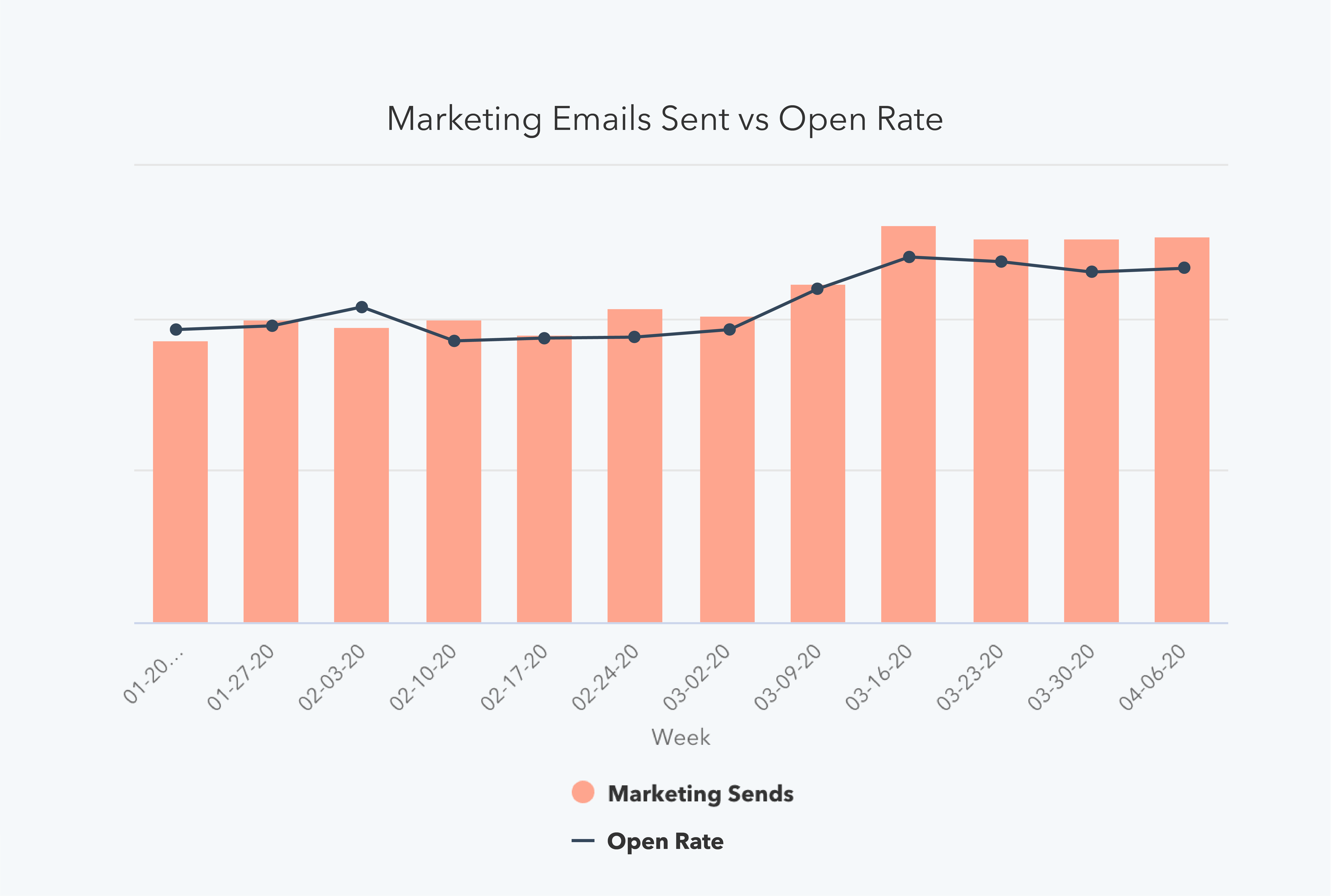

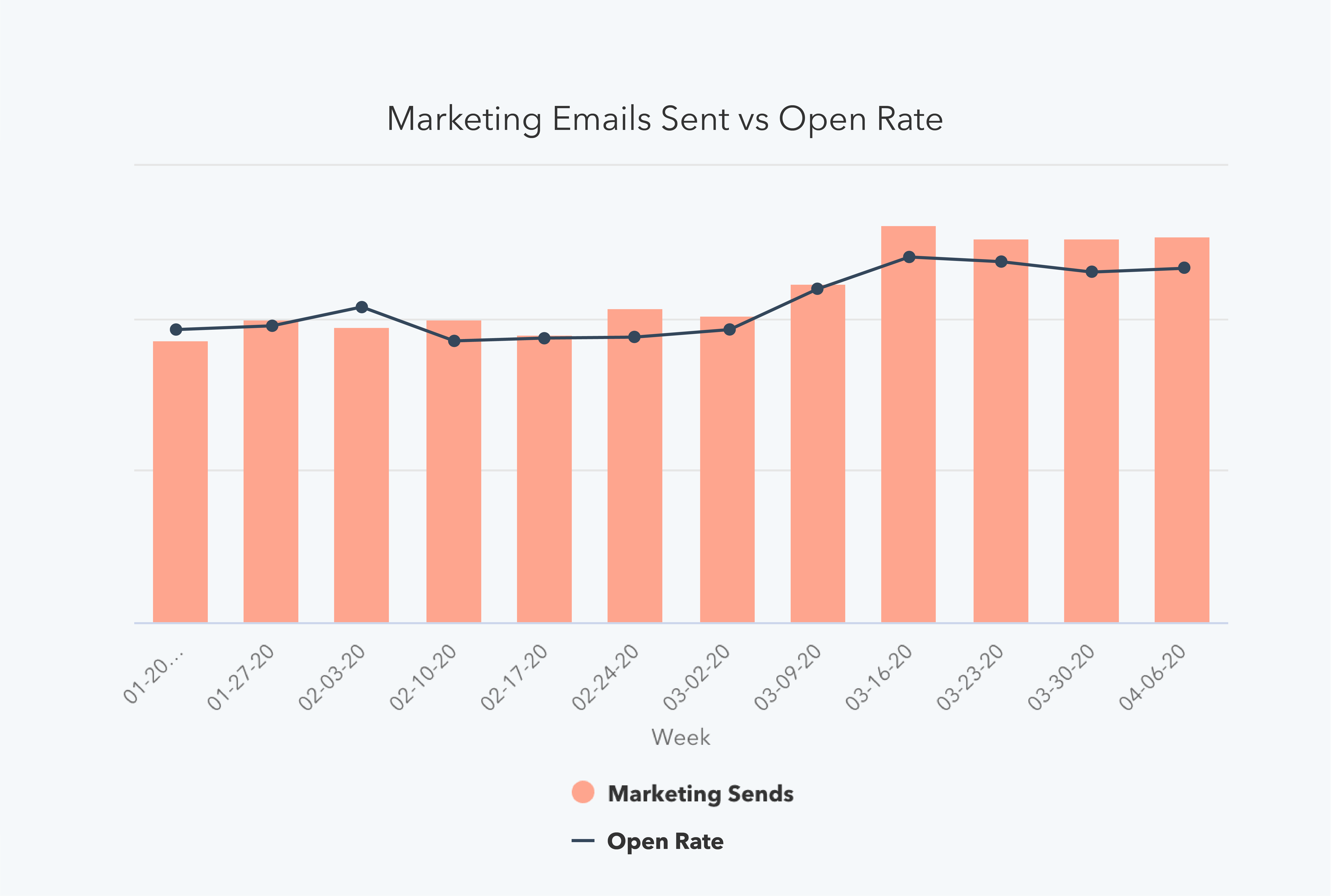

Like final week, entrepreneurs are having extra success. Clients nonetheless appear keen to interact with advertising supplies, as open charges climbed one other 8% this week. Advertising electronic mail quantity started to stabilize week-over-week, however the whole quantity of electronic mail despatched remains to be far larger than pre-COVID ranges.

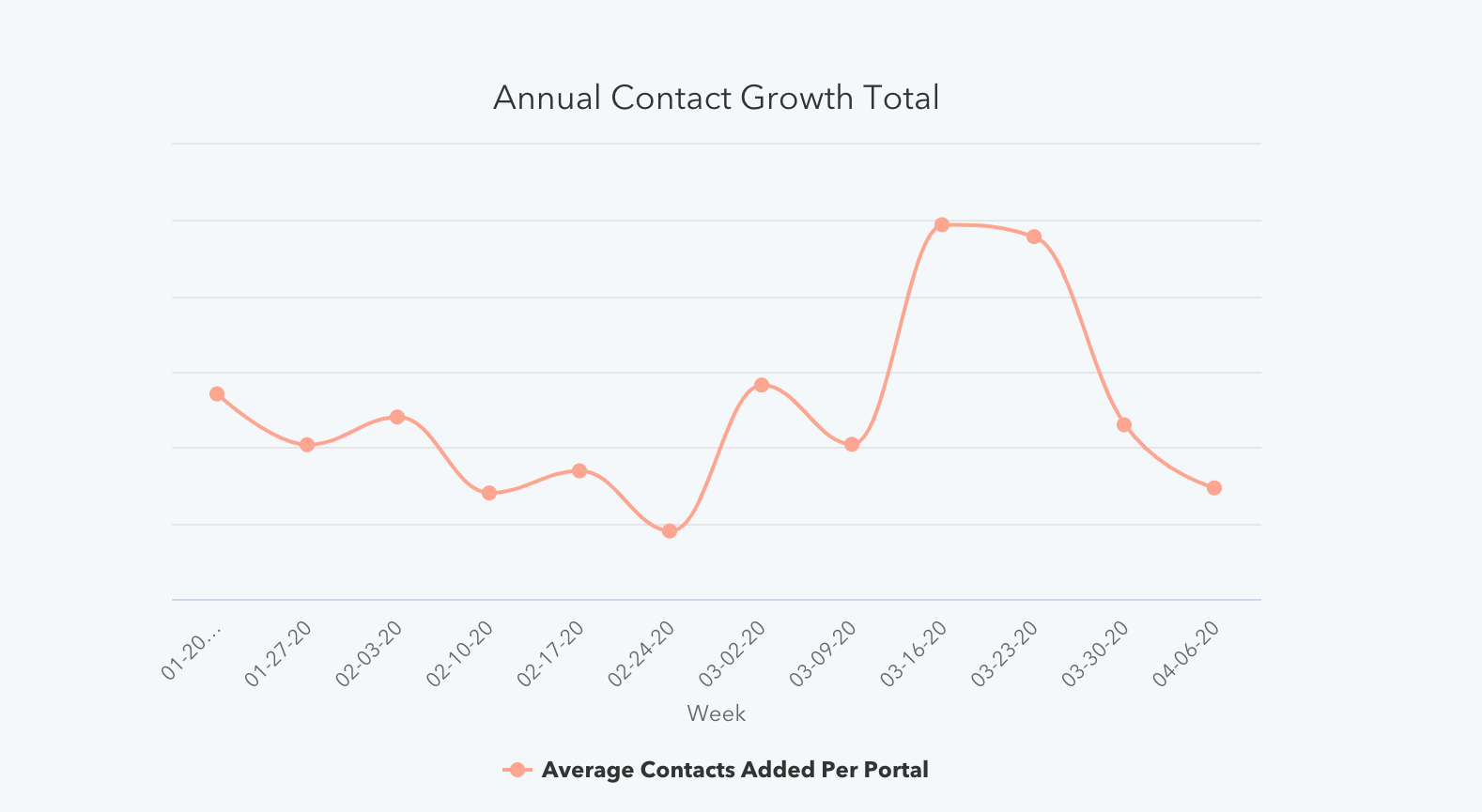

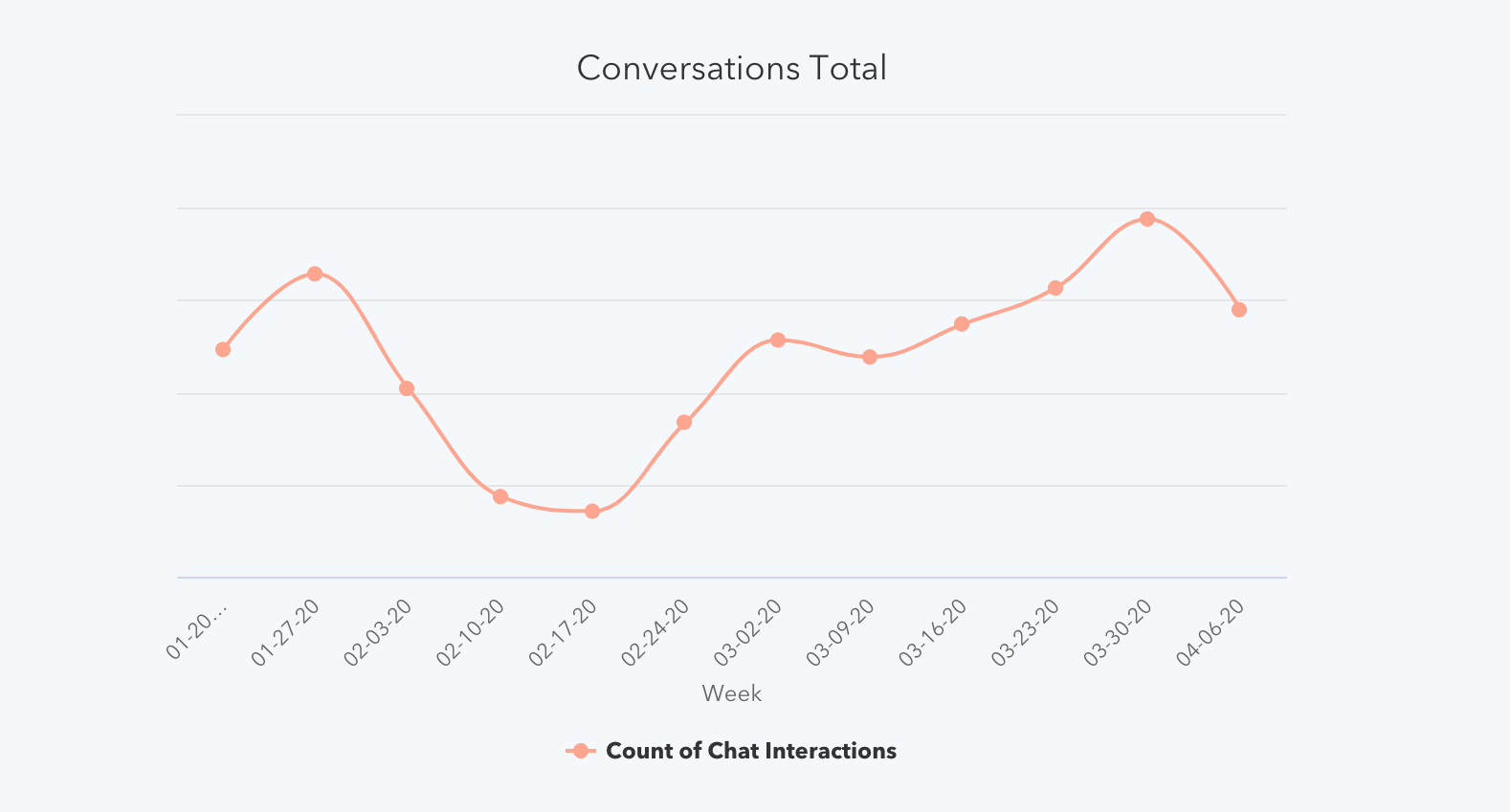

Purchaser-initiated chat and database development recommend that clients are nonetheless on the market. Chat quantity, regardless of declining final week, remains to be far above pre-COVID averages. Database development presently sits at February ranges; whereas the aggressive development of the previous couple of weeks has slowed, it’s encouraging to see that the metric remains to be holding regular with historic averages for now.

Surprisingly, companies of all sizes have been impacted virtually equally. Our knowledge confirmed that consumers demonstrated neither a choice for supporting small companies, nor a need to purchase from extra established and steady firms. You possibly can discover all the dataset here.

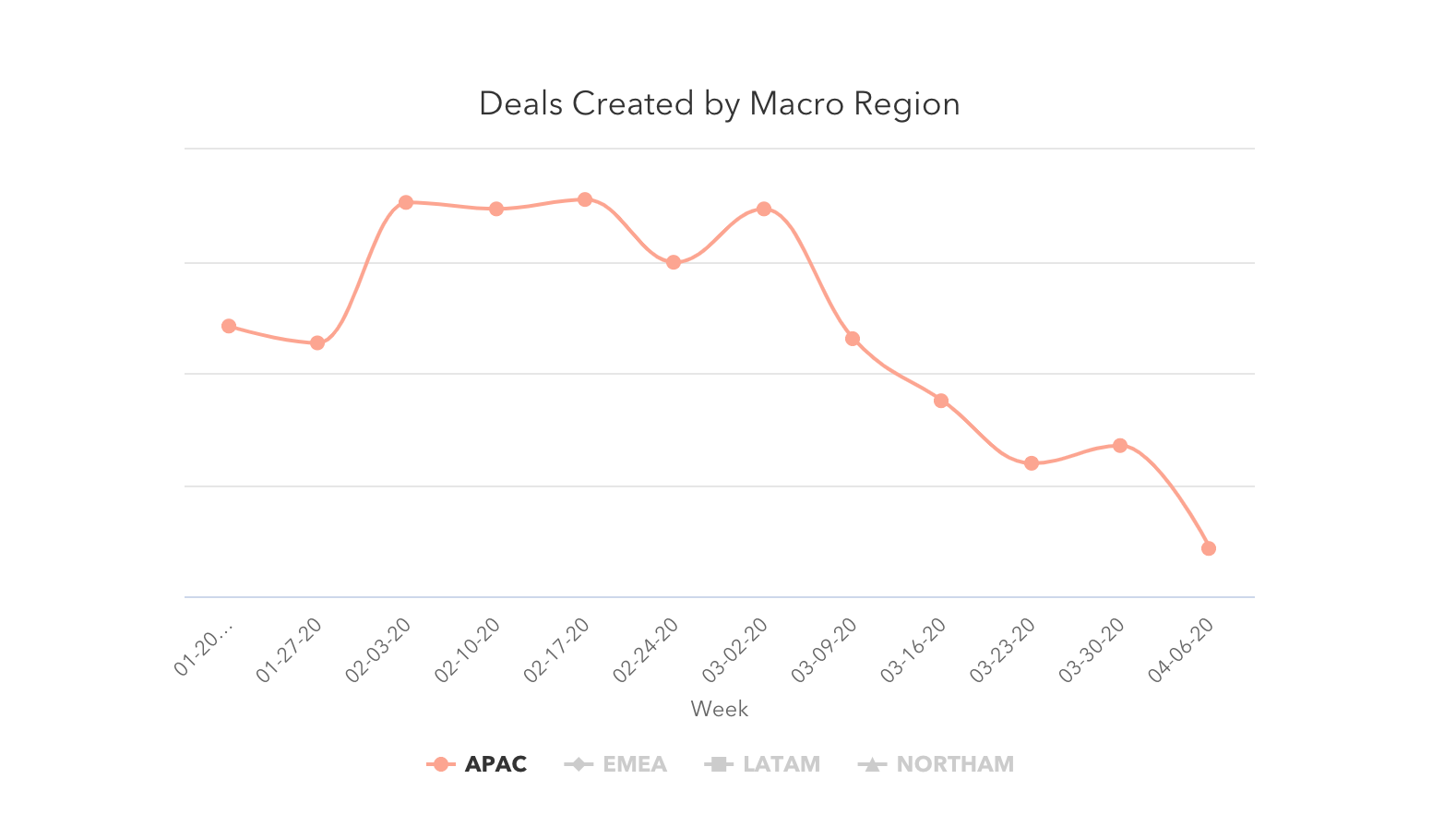

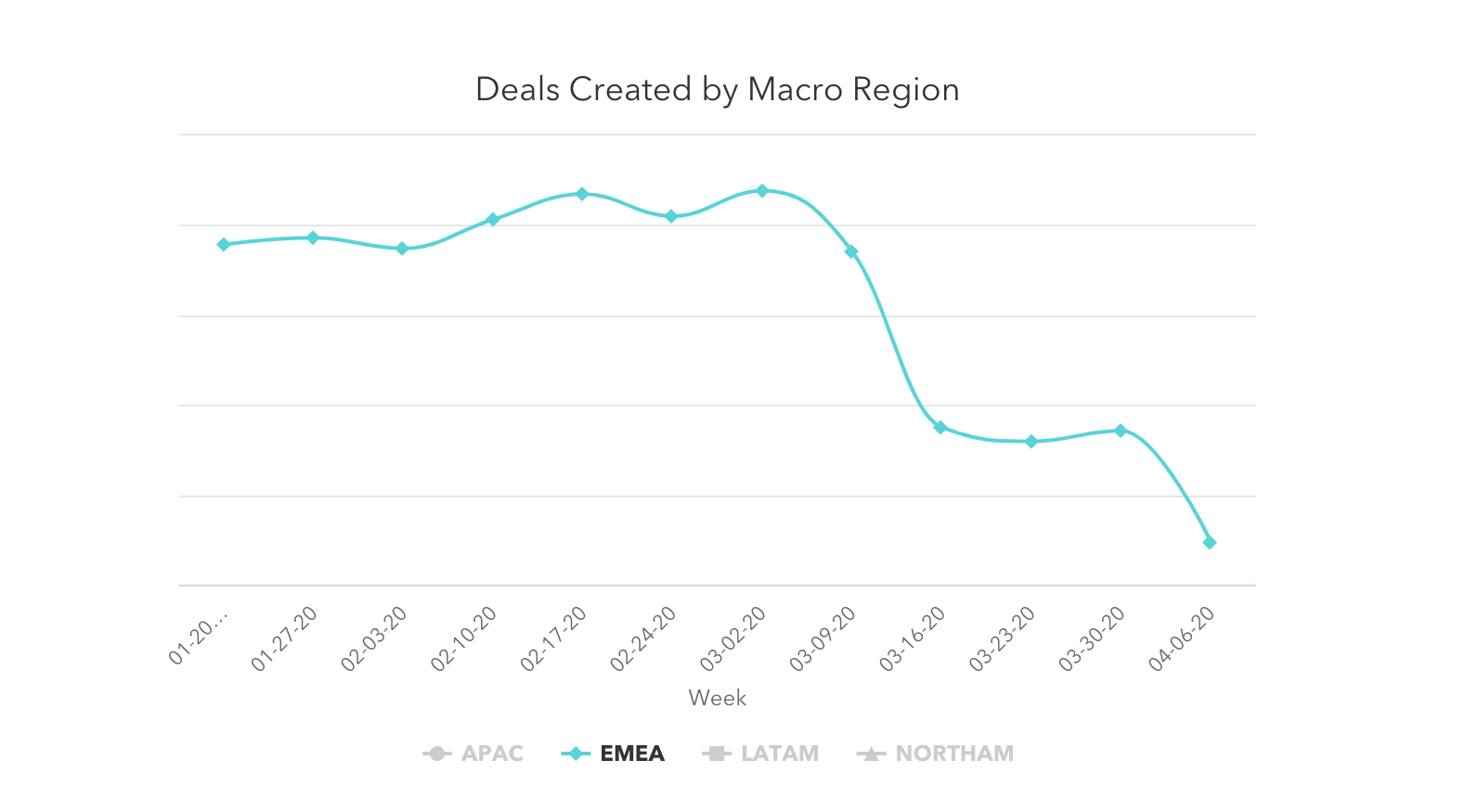

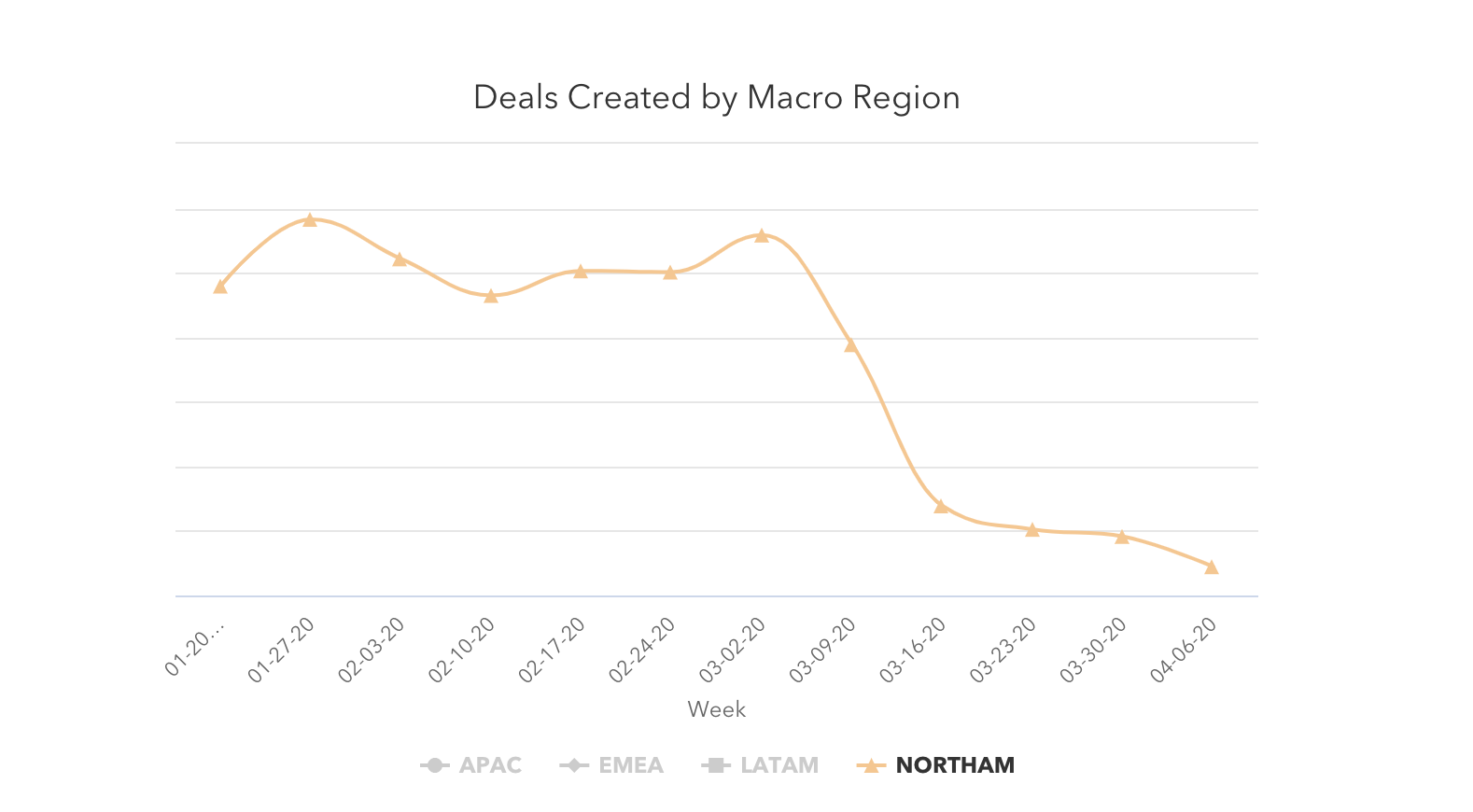

Offers created are down in each area. North America noticed the smallest decline (a 3% lower the week of April 6). EMEA and LATAM had the most important with 19% and 16% drops, nevertheless it’s price noting that enterprise closures for Easter might have contributed to the drop in these areas.

Offers closed dropped 19% as effectively, although we count on to see this occur between an end-of-quarter week and the primary week of a brand new quarter. A few of this lower might come from the 15% drop in offers created the week of March 23, however the bulk of that influence will possible be felt within the coming weeks, so count on this quantity to proceed shifting. We’ll be watching it carefully.

The week of April 6 noticed the bottom weekly quantity of closed offers this yr.

Different on-line metrics seemed wholesome as effectively. Month-to-month web site visitors elevated by 13% in March, in comparison with February.

.png?width=1070&name=Website%20traffic%20Column%20(1).png)

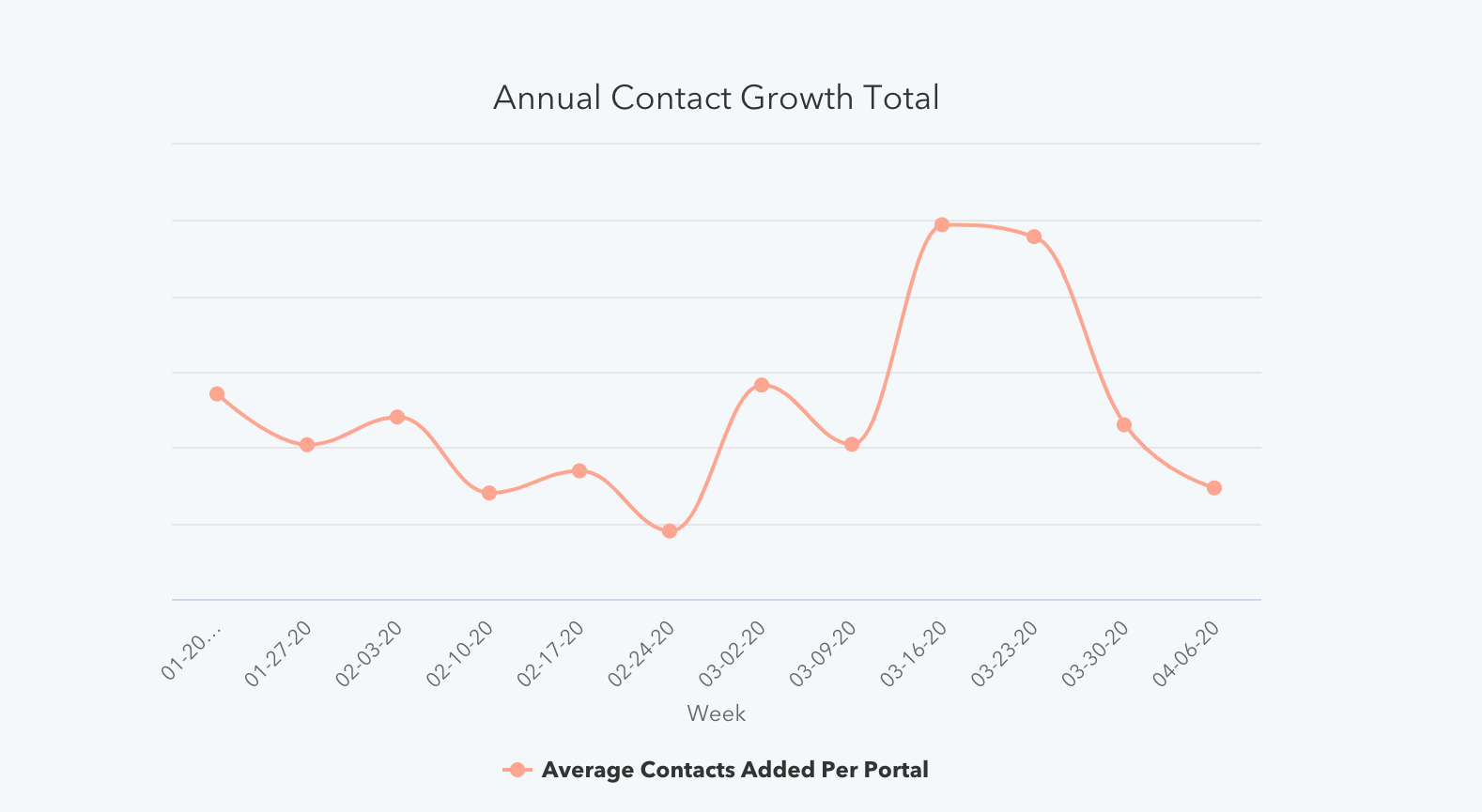

The typical variety of contacts added to portals dropped 19% final week, after a 36% drop the week of March 30. These seem like huge drops, however the common weekly variety of contacts remains to be on the identical degree of February weekly averages. Proceed watching this metric carefully.

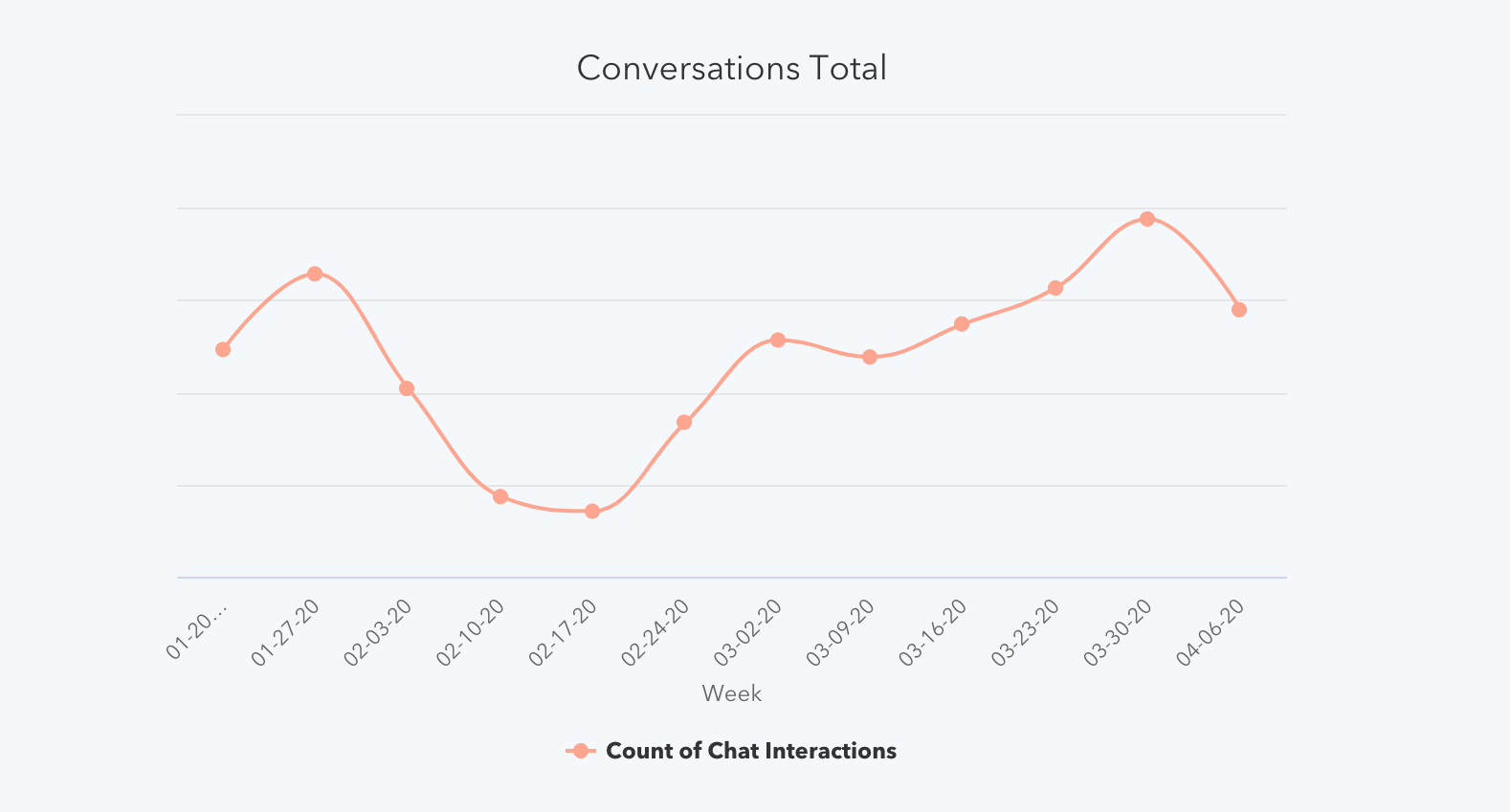

The variety of customer-initiated conversations dropped 4.5% the week of April 6, after regular development all through March. This drop didn't wipe out March’s positive factors, as final week’s numbers are nonetheless effectively above pre-COVID ranges.

Open charges on these emails proceed to develop. April 6 noticed an open price of 25.5%, the best single-week common of 2020, and an 8% improve from the prior week.

This prospecting continues to be ineffective. Response price hit 2.1% final week, which is a 10% decrease response price than the week of Christmas in 2019. That is the bottom weekly response price of 2020 to date, and 40% decrease than the best response price of the yr (3.51% the week of January 6).

Not solely is that this ineffective -- response charges hit their lowest ranges in 2020 final week -- it’s a foreboding signal for longer-term gross sales forecasts as effectively. As deal creation is one of the best indicator of future income, course-correction must occur rapidly. Many companies might want to rethink what prospecting seems prefer to bolster their long-term pipeline.

Operationally, commonly modify your gross sales projections to mirror doubtlessly prolonged gross sales cycles or decrease deal dimension so forecasts stay correct. Only a contact of course of (or enhancements to current processes) goes a good distance in creating a transparent image of your small business over time.

On particular person calls, encourage your staff to emphasise a useful, consultative promoting method. Sure elements, like your clients’ finances and willingness to enter gross sales conversations at this second, are out of your management. As a substitute of chilly calling your entire database, use your data of your clients’ industries to prioritize reaching out to:

Your clients could also be extra excited by studying and training proper now. Our personal web site has seen an uptick in visits to instructional assets like our weblog, certifications, and Academy lessons.

As a substitute of dialing up the promotion of your services and products throughout a disaster -- an method that could be insensitive to your buyer base, deal with nurturing the long-term relationship. Establish the place you possibly can assist your clients right this moment, with out asking for something in return.

Investing in chatbots to get clients solutions extra rapidly, automate lead qualification or ebook conferences may also help your organization meet the rise in buyer inquiries.

That’s why from now till the tip of June, we might be publishing week-over-week pattern knowledge for core enterprise metrics together with resembling web site visitors, electronic mail ship and open charges, gross sales engagements, shut charges and extra. We plan so as to add extra cuts, like channel and area, over time.

This week, we’ve added an extra dimension to our dataset -- firm dimension. You possibly can discover all the info we’re publishing here.

Concerning the Information

- These insights are based mostly on aggregated knowledge from over 70,000 HubSpot clients globally.

- The dataset consists of weekly pattern knowledge for core enterprise metrics in 2020, specializing in adjustments occurring throughout and after March 2020.*

- Charts on this publish are measured in opposition to a benchmark on the y-axis. The benchmark for every metric was calculated by taking weekly averages from January 20, 2020 by March 9, 2020.

- The information from HubSpot’s buyer base displays benchmarks for firms which have invested in a web-based presence and use inbound as a key a part of their development technique.

*The unfold of COVID-19 has had a unique timeline in numerous areas, so we're utilizing the World Well being Group's declaration of a worldwide pandemic on March 11, 2020 as our “official” begin date.

NOTE: As a result of the info is aggregated from HubSpot clients’ companies, please remember the fact that particular person companies, together with HubSpot’s, might differ based mostly on their very own markets, buyer base, trade, geography, stage, and/or different elements.

What We’re Seeing

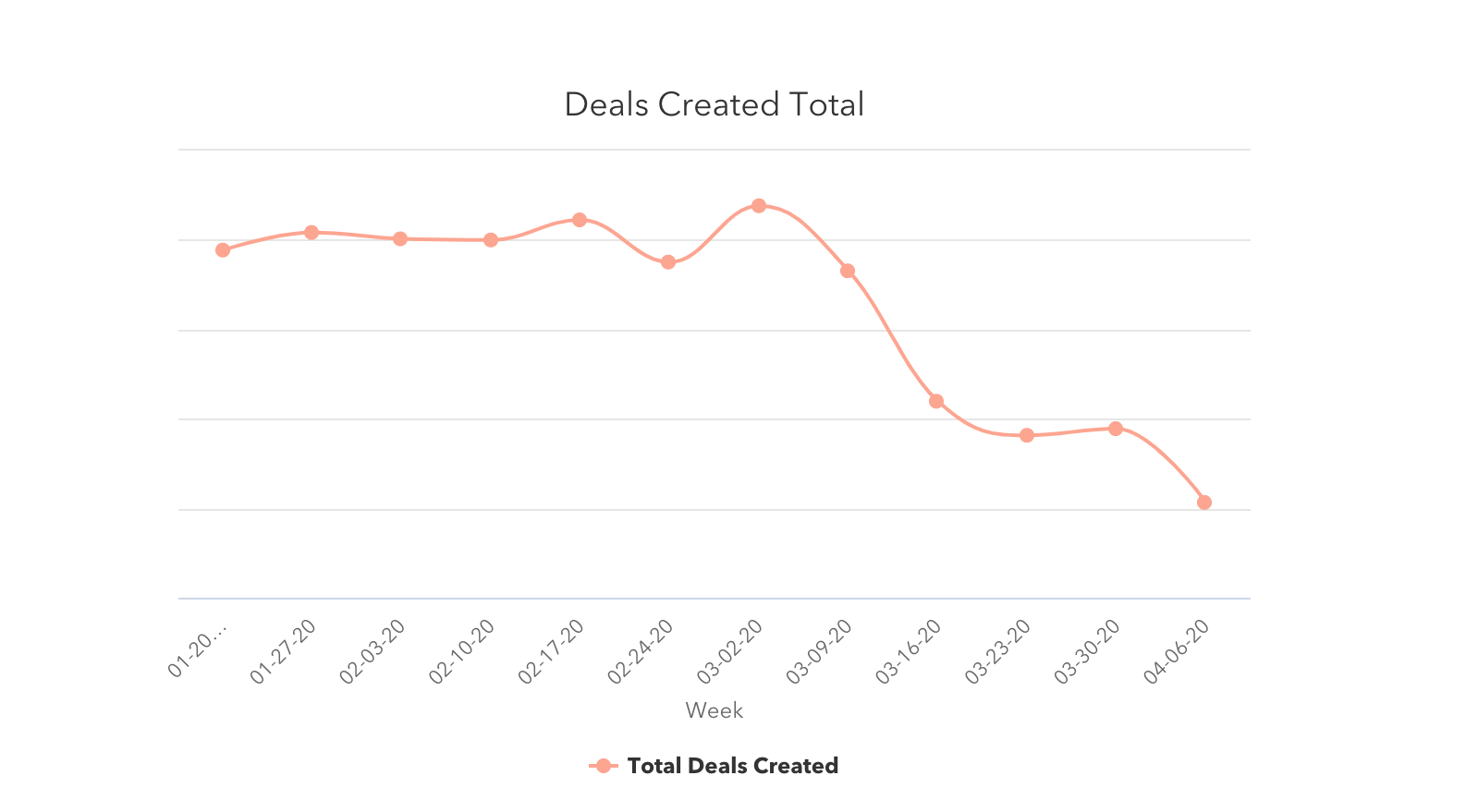

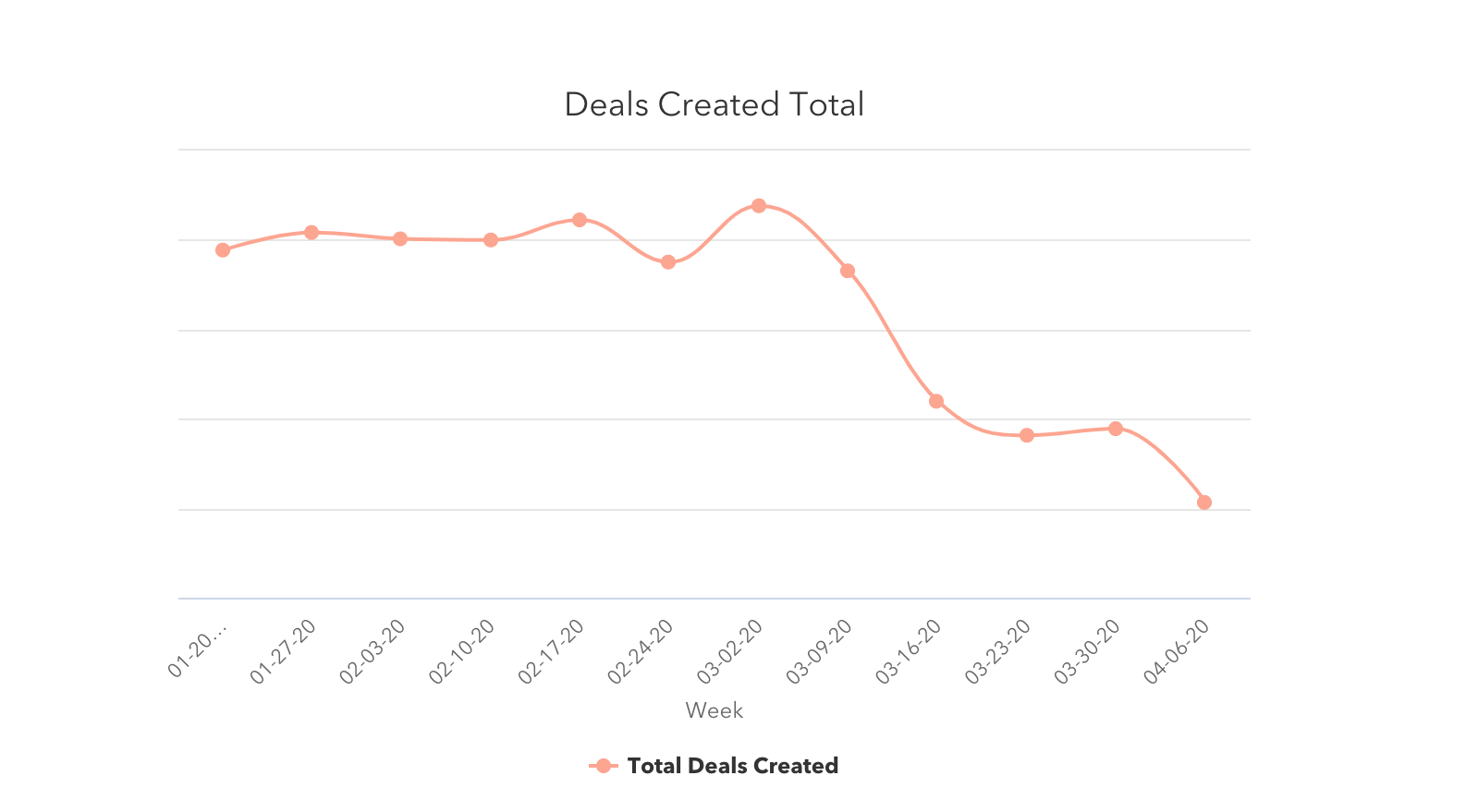

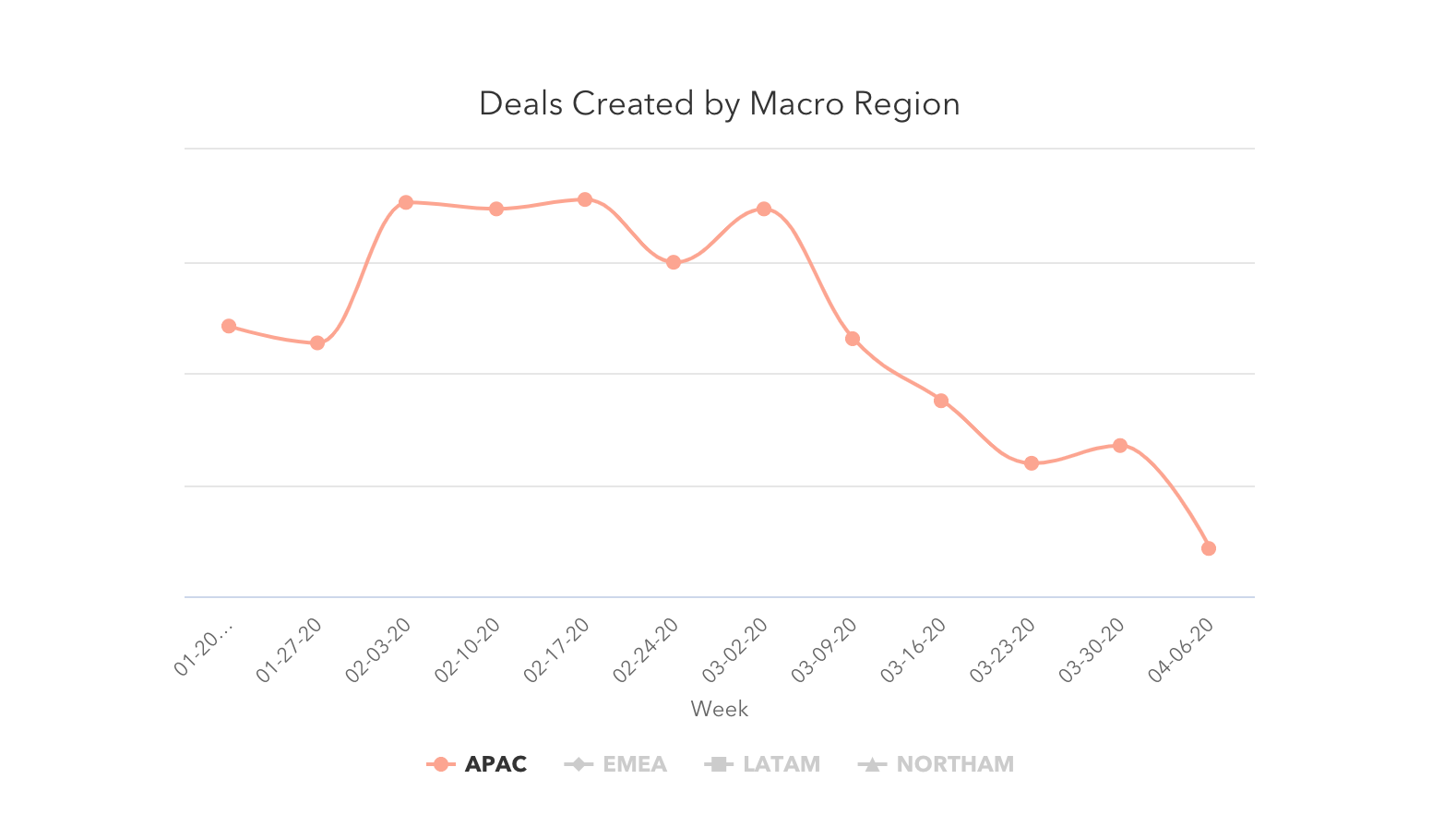

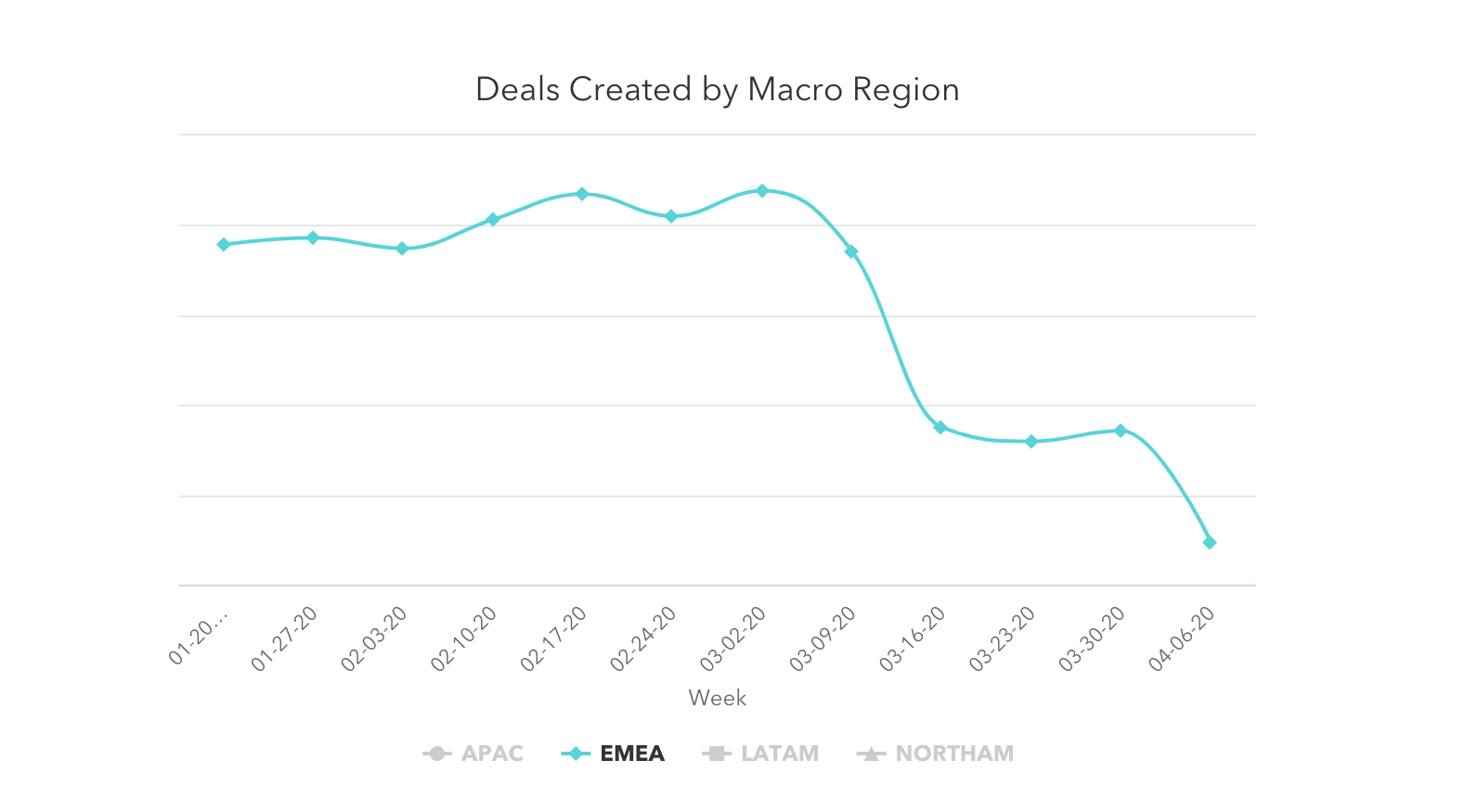

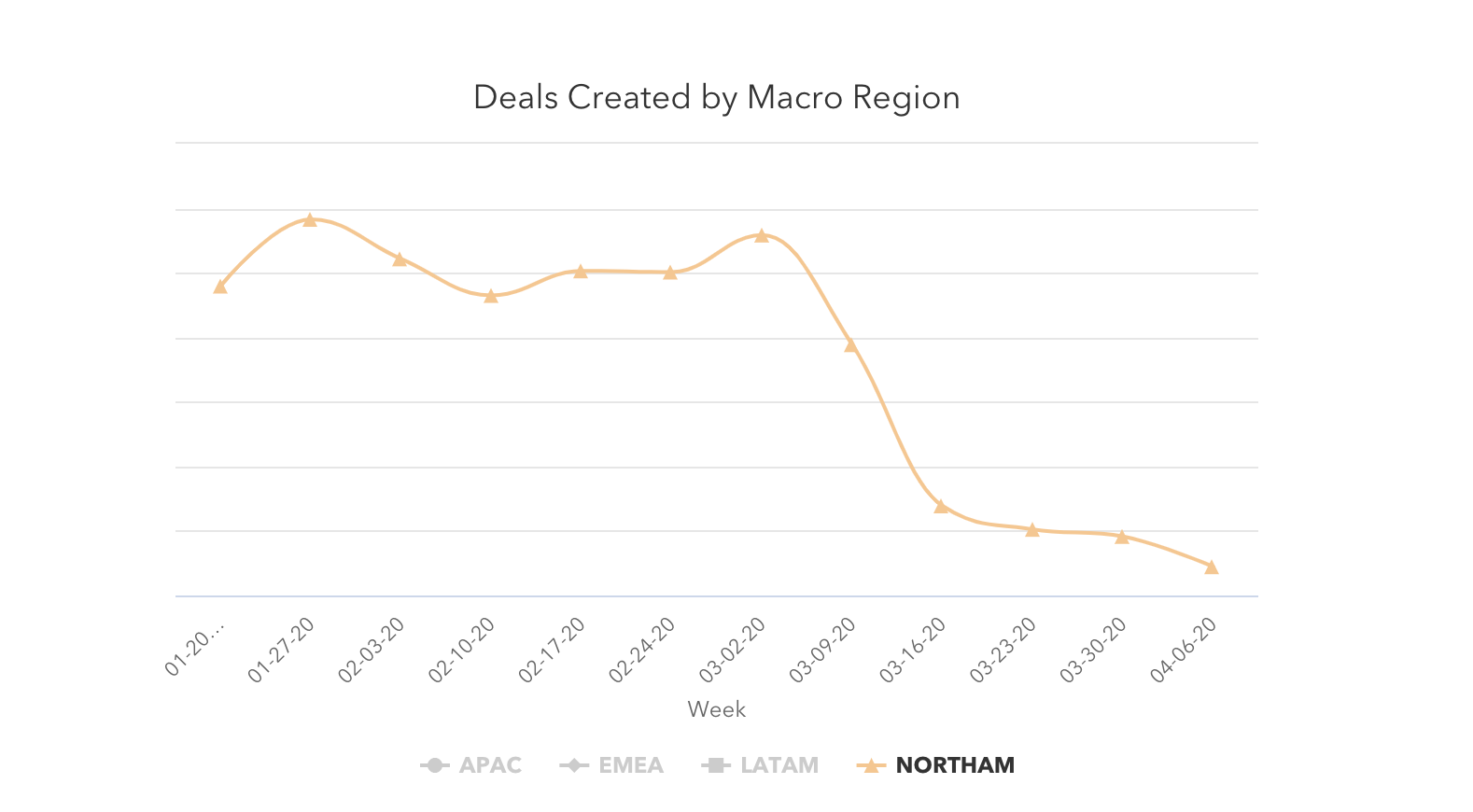

After a slight rally the week of March 30, each the variety of new offers created and offers marked closed-won in HubSpot CRM dropped the week of April 6, significantly in EMEA and LATAM. The Easter vacation partially contributed to an end-of-week dip in deal quantity in all areas, however deal creation was already trending downward earlier than the vacations. As a number one indicator of future income, continued decreases in deal creation right here don’t bode effectively for April and Q2 gross sales outcomes. We might be watching this metric carefully.Gross sales groups are sending about 50% extra electronic mail to prospects than they have been pre-COVID, however responses proceed to drop. Final week, gross sales response charges hit an all-time low for 2020 at 2.1%, a decrease response price than Christmas week 2019.

Like final week, entrepreneurs are having extra success. Clients nonetheless appear keen to interact with advertising supplies, as open charges climbed one other 8% this week. Advertising electronic mail quantity started to stabilize week-over-week, however the whole quantity of electronic mail despatched remains to be far larger than pre-COVID ranges.

Purchaser-initiated chat and database development recommend that clients are nonetheless on the market. Chat quantity, regardless of declining final week, remains to be far above pre-COVID averages. Database development presently sits at February ranges; whereas the aggressive development of the previous couple of weeks has slowed, it’s encouraging to see that the metric remains to be holding regular with historic averages for now.

Surprisingly, companies of all sizes have been impacted virtually equally. Our knowledge confirmed that consumers demonstrated neither a choice for supporting small companies, nor a need to purchase from extra established and steady firms. You possibly can discover all the dataset here.

How Metrics Modified in March

The variety of offers created continues to say no, significantly in EMEA and LATAM.

After a slight end-of-quarter rally the week of March 30, the variety of offers created dropped 11% the week of April 6.

Offers created are down in each area. North America noticed the smallest decline (a 3% lower the week of April 6). EMEA and LATAM had the most important with 19% and 16% drops, nevertheless it’s price noting that enterprise closures for Easter might have contributed to the drop in these areas.

Offers closed dropped 19% as effectively, although we count on to see this occur between an end-of-quarter week and the primary week of a brand new quarter. A few of this lower might come from the 15% drop in offers created the week of March 23, however the bulk of that influence will possible be felt within the coming weeks, so count on this quantity to proceed shifting. We’ll be watching it carefully.

The week of April 6 noticed the bottom weekly quantity of closed offers this yr.

Patrons proceed participating with companies on-line.

Purchaser-initiated chat quantity dropped barely, however remains to be round 10% larger than pre-COVID ranges -- conversational advertising stays priceless to companies. Database development has slowed but additionally has not fallen beneath February averages.Different on-line metrics seemed wholesome as effectively. Month-to-month web site visitors elevated by 13% in March, in comparison with February.

.png?width=1070&name=Website%20traffic%20Column%20(1).png)

The typical variety of contacts added to portals dropped 19% final week, after a 36% drop the week of March 30. These seem like huge drops, however the common weekly variety of contacts remains to be on the identical degree of February weekly averages. Proceed watching this metric carefully.

The variety of customer-initiated conversations dropped 4.5% the week of April 6, after regular development all through March. This drop didn't wipe out March’s positive factors, as final week’s numbers are nonetheless effectively above pre-COVID ranges.

Engagement with advertising emails continued growing and responses to gross sales outreach reached new lows.

Advertising electronic mail open charges elevated as quantity held regular.

Advertising electronic mail quantity has held regular the final three week, rising by lower than half of a p.c the final two weeks. That being mentioned, total quantity the week of April 6 remains to be larger than pre-COVID ranges by about 20%.Open charges on these emails proceed to develop. April 6 noticed an open price of 25.5%, the best single-week common of 2020, and an 8% improve from the prior week.

Gross sales electronic mail quantity dropped for the primary time in eight weeks, as response charges reached a document low.

Outreach was down virtually 4% final week -- the primary time this quantity has trended downward since February 17 -- however the whole quantity of electronic mail despatched remains to be round 50% larger than pre-COVID ranges.This prospecting continues to be ineffective. Response price hit 2.1% final week, which is a 10% decrease response price than the week of Christmas in 2019. That is the bottom weekly response price of 2020 to date, and 40% decrease than the best response price of the yr (3.51% the week of January 6).

Transitioning to remote work for the first time? We teamed up with Slack to create this guide to moving your business online.

What This Means for Companies

Focused prospecting issues greater than ever.

This week’s headline is the 11% drop in new deal creation, whereas gross sales outreach nonetheless stays far larger than pre-COVID ranges. Some improve in electronic mail prospecting is anticipated as outdoors gross sales groups have transitioned inside, however this doesn’t totally account for the acceleration of gross sales outreach. As a substitute, the info means that many gross sales groups have reacted to the financial local weather by reaching out to a considerably broader base of prospects than they usually would goal.Not solely is that this ineffective -- response charges hit their lowest ranges in 2020 final week -- it’s a foreboding signal for longer-term gross sales forecasts as effectively. As deal creation is one of the best indicator of future income, course-correction must occur rapidly. Many companies might want to rethink what prospecting seems prefer to bolster their long-term pipeline.

Operationally, commonly modify your gross sales projections to mirror doubtlessly prolonged gross sales cycles or decrease deal dimension so forecasts stay correct. Only a contact of course of (or enhancements to current processes) goes a good distance in creating a transparent image of your small business over time.

On particular person calls, encourage your staff to emphasise a useful, consultative promoting method. Sure elements, like your clients’ finances and willingness to enter gross sales conversations at this second, are out of your management. As a substitute of chilly calling your entire database, use your data of your clients’ industries to prioritize reaching out to:

- Industries which have been minimally impacted or these which are remodeling rapidly to fulfill the brand new challenges

- Industries the place your options are significantly related or helpful on this second

Sources to Assist

Free Software program to Get Began

Deal with training, not promotion.

The rise in web site visitors and advertising electronic mail open charges recommend that clients are nonetheless trying to have interaction with firms.Your clients could also be extra excited by studying and training proper now. Our personal web site has seen an uptick in visits to instructional assets like our weblog, certifications, and Academy lessons.

As a substitute of dialing up the promotion of your services and products throughout a disaster -- an method that could be insensitive to your buyer base, deal with nurturing the long-term relationship. Establish the place you possibly can assist your clients right this moment, with out asking for something in return.

Sources to Assist

Free Software program to Get Began

Incorporate chat into your technique.

Whereas chat quantity declined week-over-week, whole quantity nonetheless far exceeds pre-COVID ranges. Conversational advertising presents a real-time strategy to reply buyer questions, in addition to automating the lead routing course of so your small business can serve potential and current clients even when your staff is out of the workplace.Investing in chatbots to get clients solutions extra rapidly, automate lead qualification or ebook conferences may also help your organization meet the rise in buyer inquiries.

Sources to Assist

Free Software program to Get Began

We hope these benchmarks present helpful context as you monitor your small business’ well being within the coming months. We plan to refresh these insights and add additional breakdowns over time (resembling by channel and firm dimension). You possibly can signal as much as be notified of recent insights as they’re accessible right here.

Source link

Comments

Post a Comment